KAMIC Group

2023/24 (October – September)

For the Group as a whole, a slightly weaker business climate is noticeable, although with clear variations between customer segments and geographical markets. The high level of interest rates in Europe is dampening activity in building and construction and increasing customer caution ahead of major investment projects, particularly in telecoms and equipment for electronics production.

At the same time, the business situation remains favourable for many of the Group’s companies. These are largely active in markets and segments driven by structural trends and where they are well positioned with strong offerings, for example in electrification and the transition to green technology, as well as input goods for the defence and process industries.

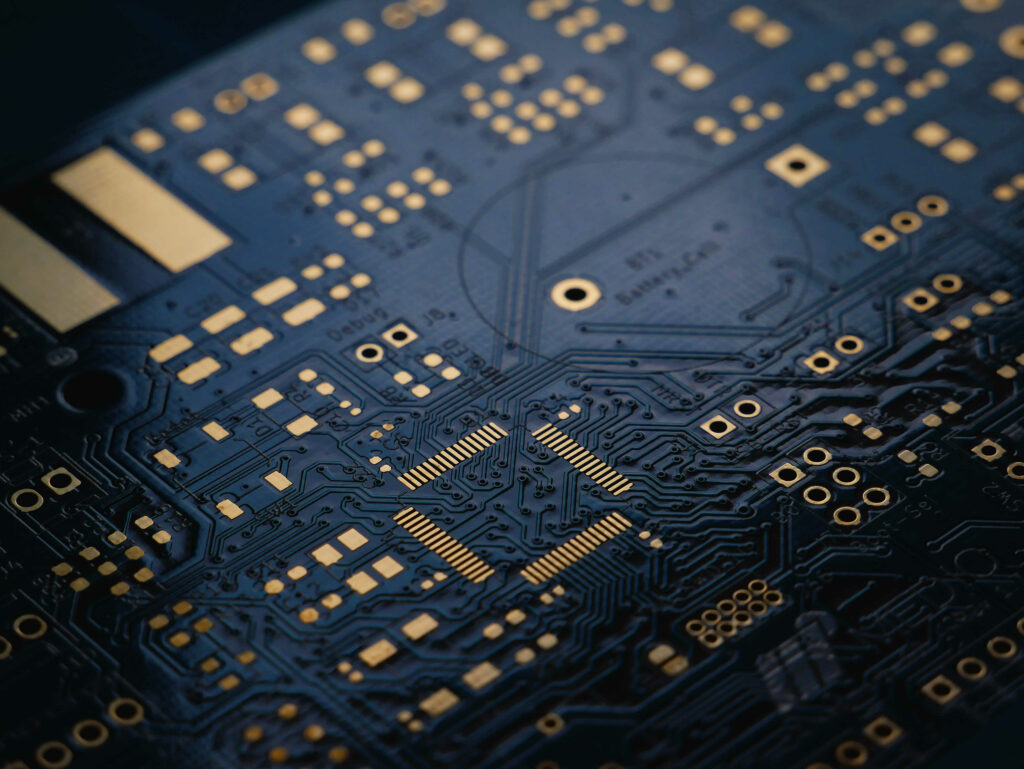

For the Electronics business area, this means continued strong development, with the more recently acquired companies in particular performing above expectations. The Installation business area has a mixed development, with high sales volumes in evacuation technology and shielding (EMC) but lower in other segments. The Production Technology business area is adjusting to a weaker market. The same applies to companies in the Magnetics business area that supply the telecom and transport industries, while volumes remain high to customers in the defence industry.

Supported by the Group’s strong financial position, eight companies were acquired during the year. The new companies are CLP System, Tramo ETV and Unitrafo in Sweden, Gersprenztal Transformatoren in Germany and the Polynom group with four companies in Switzerland and the UK. With the establishments in Switzerland, the Group’s geographical presence is extended to 16 countries.

2022/23 (October – September)

The global political situation remains very unsettled and the economies of many of the countries in which we operate are under pressure from rising interest rates and high inflation. Despite this, the business situation is stable to favourable for most of our companies. With strong positions in market niches with structural growth, most businesses are showing good volume growth while several major acquisitions are contributing to margin improvements.

Demand in the Electronics business area is generally good, with particularly good volume growth for customers in the automotive industry, defence and communication. The Installation business area is affected by the stalled housing construction in the Nordic region, while operations in shielding technology and encapsulated electrical technology are developing positively. For Production Technology, demand for machines and consumables remains stable, and in Magnetics the production units are delivering at full capacity, supported by a well-filled order book.

During the financial year we welcome six new companies to the KAMIC family, which strengthen the Group’s positions in several prioritized market niches. In the Electronics business area the Swedish companies MVS and Boxco are added, in Magnetics the British companies Avon Magnetics and AGW Electronics, in Installation the Finnish company Finelcomp and Production Technology is strengthened by the Finnish company Easy-Cad and the German company SmartRep.

2021/22 (October – September)

The effects of the Covid pandemic are abating but some impact remains in the form of continued shortages of components and sluggish supply chains. Meanwhile, geopolitical unease is increasing as a result of Russia’s invasion of Ukraine which among other things has caused severe disturbances in the international energy market. At the same time, interest rates are rising and inflation is gaining momentum.

Despite a turbulent environment, the business situation remains favourable for most of the group’s operations. With strong niche positions in segments which benefit from underlying trends and structural changes, demand for our products is increasing. Results are following rising volumes well and the Electronics and Magnetics business areas achieve record results. In Installation the units that deliver evacuation and screening technologies show good growth and in Production Technology machine sales are at a high, which also generates good revenue for service and spare parts.

The financial year sees the acquisition of the Swedish company GB Trading Security which sells security products such as alarm and CCTV systems, as well as Norwegian Tavelbyggern which strengthens the group’s position in encapsulated electrical technology.

2021

Despite the ongoing Covid pandemic with tough restrictions for workplaces and travel, underlying demand is strong in the most important customer segments and geographies. Increased component shortages and transport bottlenecks further intensify demand since many customers build up buffer stocks. The group’s aggregated order book therefore strengthens significantly in the second half of the year. High volumes, well-managed control of costs and good handling of price increases from suppliers create strong results especially in the business areas Electronics, Magnetics and Production Technology.

Company acquisitions during the year

Eltecno – switchgear and power distribution in Vellinge, Sweden.

Talema Group – development and production of magnetic components, with sales offices and production facilities in Ireland, USA, Germany, Czech Republic and India.

Elproman – special cables and connectors in Segeltorp, just south of Stockholm.

Electro Design – manufacturer of automation equipment for printed circuit board production. Operations in Gimo, Sweden.

Group structure clean-up

With the aim of improving clarity some changes are made to the group structure of KAMIC Group and our two sister groups, Amplex and Mindelon. With effect from the 2021/22 financial year (starting 1 October), KAMIC Group consists of all the electrical and electronics companies in the sphere, Amplex is home for all companies with operations in lifting technology, materials handling and industrial safety and the third group, Mindelon, gathers all companies within Retail Solutions.

2020

The Covid-19 pandemic has a global impact and affects both individuals and companies. The effects for KAMIC Group are split since willingness to invest in more capital-intensive machine projects fall while demand for components and systems remains strong. Differences are also seen geographically with our operations in the UK and Poland most affected by the pandemic while effects in the Nordic countries are clearly milder.

Overall volumes hold up well, and in those companies where volumes fall action is taken to adapt costs. A combination of long-term measures and short-term cost reductions in the form of government-subsidised furloughing as well as reduced travel costs have a good effect and profitability for the group strengthens compared with the previous year.

Despite the uncertainty around the pandemic, the group continue to be active with acquisitions. Liftsafe Group with 130 employees in Canada and the USA is acquired. The company supplies lifting equipment and safety equipment to industry. A smaller acquisition is made of WEAB, a manufacturer of advanced electronics based in Torsby, Sweden. Subsequently two Norwegian companies are acquired, Langsjøen Elektro and Moss Automation, which are both specialists in solutions within encapsulated electrical technology such as switchgear and distribution boards.

2019

The majority of companies in the group experience a continuing stable business climate with good demand. In the UK, the Brexit situation is worrying for some companies but is not causing any major disruption. Organic growth and somewhat stronger margins mean that the group shows good earnings development.

During the year a number of acquisitions are made which broaden and strengthen the business areas’ operations:

– In January, British Distec, a supplier of advanced display solutions, was acquired.

– In April, Swedish Robotteknik Vetlanda, a specialist in industrial automation.

– In May, Swedish Swetouch, which delivers customised solutions for control panels and enclosures for HMI applications.

– In July, Swedish Leeroy Digital Signage (later renamed to Starbit), which complements the Electronics business area’s offering in digital communication services.

– In September, Norwegian Eltavler, which designs and builds switchgear and distribution boards.

Other highlights during the year include EG Electronics opening an operation in the USA and Scanditron celebrating 50 years as a company.

2018

The market climate remains positive and most business areas and companies show good growth and earnings development.

The Magnetics business area’s position in the UK is strengthened through the acquisition of SIGA Electronics, a British manufacturer of transformers and inductors.

The Production Technology business area’s operations are expanded through the acquisition of STAC, a Swedish specialist in equipment for cable production.

Electronics’ sales continue at a stable and good level. The RF & microwave unit is showing especially strong development.

In Installation things are somewhat slower in the lighting area where there is tough price pressure in the market. At the same time, the volume development is positive in the new Evacuation Technology unit where the offering within EMS and UPS is now consolidated.

2017

The favourable industrial cycle continues and the Group’s sales are increasing. Volume growth is especially strong in the Electronics business area due to continued success with memory trading and good development in the automotive segment.

The Installation business area is successful with its more focused offering within lighting and emergency lighting.

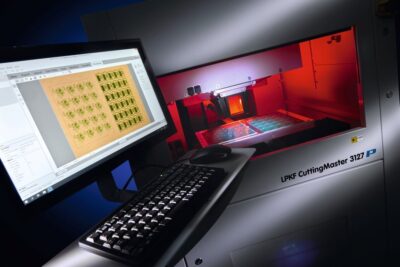

Production Technology is winning a number of major machine projects and demand for stencils and consumables continues to be good.

Magnetics has a tougher time with falling demand from customers in the telecom sector. However, with a flexible production apparatus and clear cost awareness, it is possible to act quickly and make necessary adjustments.

During the year, two company acquisitions are made. Through the acquisition of Grandchain Ltd., a specialist manufacturer of magnetic components in England, development resources are strengthened in the Magnetics business area. The Group also acquires Instrumentcompaniet AS, a leading supplier in Norway of measurement instrument for industrial use.

2016

The Inteno group of companies is divested to the investment fund Accent Equity. Through the sale, KAMIC Group significantly strengthens its solvency ratio and increases its freedom of action for future mergers and acquisitions. After the sale, the Group consists of four business areas: Installation, Electronics, Production Technology and Magnetics.

For Installation, the new strategy in the Light & Safety division, with a sharper focus on a more limited number of product areas, gains increasing momentum.

In Electronics, the year’s most remarkable feat is powerful volume growth in the memory trading business.

For Production Technology, the market for equipment is stable whilst sales of consumables show a positive trend. However, stencil operations in South Africa have failed to reach the anticipated volumes and KAMIC Group chooses to withdraw from this joint venture.

The Magnetics business area shows favourable development fuelled by high demand from customers in the telecom sector. The new factory in Sri Lanka is fine-tuned and enhances efficiency and flexibility in the business area.

2015

A good year, with positive sales development in most business areas and strengthening of the organisation. Through the sale of the Group’s office property in Helsinki, Finland, the level of debt is further reduced.

For the Broadband business area, the strong trend continues with successful product launches.

The Production Technology business area launches a new web shop.

The Magnetics business area opens a new factory in Sri Lanka.

In the Installation business area, a strategic realignment program is carried out to reverse a downward trend in the Light & Safety division.

EG Electronics’ head office is moved to Spånga, where KAMIC Group now gathers four of five business areas.

2014

In the Broadband business area, the trend remains positive and there is considerable interest among broadband operators in the new, proprietary software platform. Several business areas, however, experience a slow start to the year which leads the Group to launch a profitability improvement programme. The effects are soon apparent with a steady recovery and in the second half of the year a number of aggressive campaigns and recruitments can be carried out.

Additional events during the year: Division Networks within the Installation business area is sold as well as the Group’s office property in Vällingby, Sweden. Scanditron starts stencil production in South Africa through a joint venture.

2013

The market situation improves gradually. The Broadband business area shows strong development with its attractive portfolio of broadband gateways. A software company is acquired whose solutions strengthen the business area’s offering for the digital home.

An additional acquisition is made in the Magnetics business area, which gains a high quality offering of amplifiers for the audio industry.

The Electronics and Production Technology business areas show increasing sales but for the Installation business area, which is active primarily in the Swedish construction market, the business situation remains tough.

During the year, the Group conducts several co-location projects. In Sweden, the Parent Company and the companies ETAL and Scanditron move to Spånga, where Kamic Installation is already located. In Finland, four business areas are gathered at the same address in Helsinki.

2012

The year is characterised by integration activities and structural efficiency improvements in the new and larger Group. At the same time a weakening in the Nordic industrial market forces the Group to take rationalisation measures.

In the Installation business area, several companies are placed in new, larger facilities in Karlstad and a new central warehouse is established. The Broadband business area (mainly consisting of the Inteno company) enhances its offering through the launch of an in-house developed software product.

2011

ElektronikGruppen BK AB is acquired following a public tender offer on the stock exchange. Fredrik Celsing, President and CEO of ElektronikGruppen, is appointed as President and CEO of the new KAMIC Group, which consists of some 25 companies with operations in 11 countries in Northern Europe and Asia.

2010

Acquisition of the Polish cable manufacturer Iconex.

2006

Acquisition of Marelco-Vinga AB. The Group opens a sales office in Gothenburg, Sweden.

2005

Acquisition of Inteno Broadband Technology AB. The group opens a sales office in Stockholm and expands its office and warehouse facility in Karlstad, Sweden.

2004

Acquisition of Tibe Interconnect AB, Dalma Electronics AB and Juha-Elektro Oy. The business operations of LTG-Keifor are also acquired.

2003

Bromanco Björkgren AB is acquired.

2001

KAMIC Group is formed by a number of companies from the Amplex group, including KAMIC Karlstad and Microsec AB. A new sales office is opened in Spånga, Sweden. Fin-Alert Electronics Oy is acquired.

1999

KAMIC Karlstad is acquired by the Amplex group.

1991

The company focuses on trading and agency operations.

1983

KAMIC Karlstad Automatic AB (KAMIC Karlstad) is founded. Its operations consist of manufacturing of automation equipment, trading and agency sales.